Smart portfolios for

smart investors

Designed and managed by experts. We’ve crafted the optimal portfolio of crypto assets for your clients.

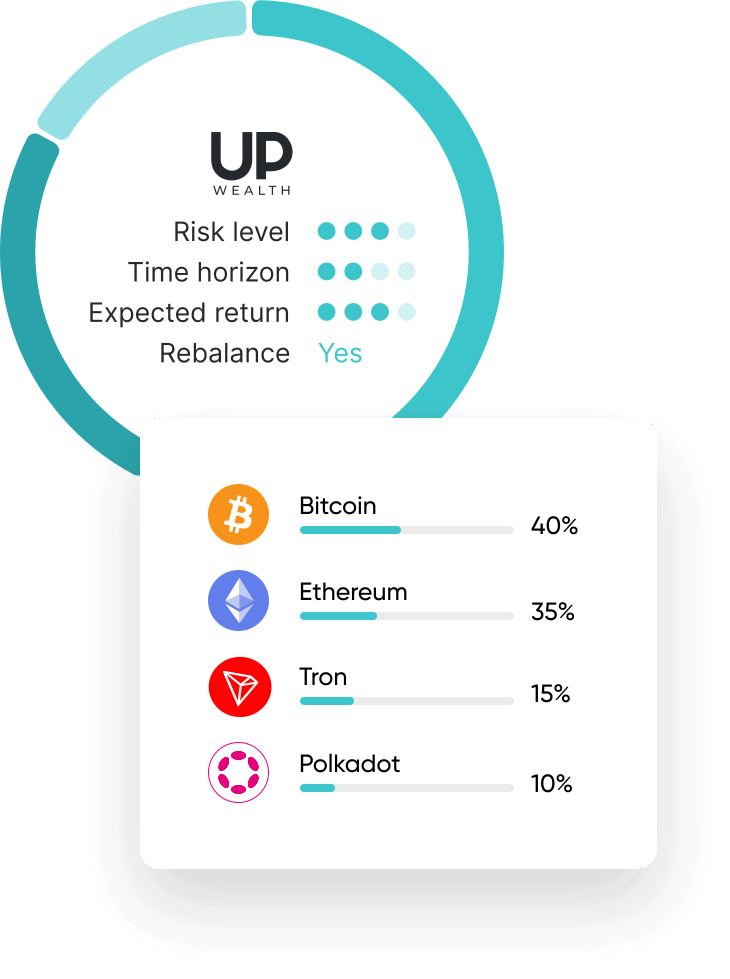

Diversified portfolios designed by experts, tailored to your clients' risk profiles and financial goals. An efficient way for clients to invest in crypto, with your guidance.

Schedule a Demo

We provide personalized recommendations aligned with your clients' preferences, offering exposure to a diverse range of cryptocurrencies. Curated portfolios are optimally allocated across Bitcoin, Ethereum, Layer 1s and 2s, DeFi, Web3, ESG, AI-related coins, and more, designed to meet your clients' investment goals.

01

clients

in minutes

Let clients answer a few questions to determine their risk tolerance and investment goals.

No problem! Upwealth makes it easy to onboard in just a few minutes.

02

customized

portfolios

Select portfolios personalized to their preferences to achieve their financial objectives.

03

let us do

the rest.

Let them allocate funds and build wealth in the crypto ecosystem – without any effort

smart investors

Designed and managed by experts. We’ve crafted the optimal portfolio of crypto assets for your clients.

Large, best-in-class

Top-rated performers

Large & Small, under-the-radar

The 2 Kings

Balanced & Blended

High-risk, high-reward

Upwealth's managed portfolios provide your clients with diversified exposure to a wide range of crypto assets, all tailored to their risk tolerance and financial goals. With our expert team handling portfolio management, your clients can benefit from professional strategies without needing to manage investments themselves. This helps minimize risk, maximize returns, and save time, giving your clients confidence in their crypto investments while you focus on delivering personalized advice.

In a few simple steps: You onboard your client via your dashboard, they receive a link to create an account, answer questions about their financial goals, and connect any wallets or exchange accounts. This allows both you and your clients to view all crypto holdings in one place. Upwealth then offers curated portfolios based on their risk tolerance and objectives, making it easier for you to provide tailored investment strategies.

At Upwealth, our platform and tools are free to use. We charge a 2% annual management fee based on your clients' assets under management (AUM)—no hidden costs, performance fees, or subscriptions. Additionally, a 0.5% transaction fee applies, similar to cryptocurrency exchanges. All fees collected are shared between you and Upwealth.

Upwealth works only with industry-leading custodians, liquidity and service providers. We are fully registered and compliant in the USA and in Europe and our team is made of licensed experts in the financial and cryptocurrency sectors.