Simplified tools for high-growing performance.

Ratings are designed to help you make more informed decisions in order to maximize gains, minimize risks while outperforming the market.

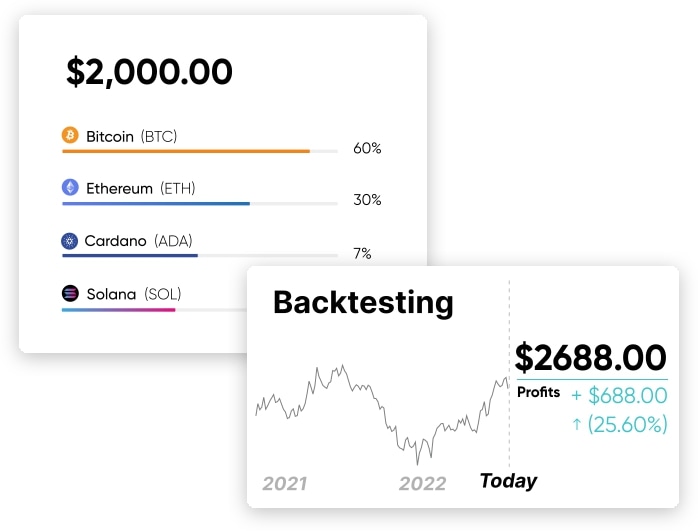

Portfolio backtesting allow you to analyze portfolio returns using historical data. Compare between a buy & hold strategy and a rebalancing strategy to evaluate what could be the best next move.

Rebalance portfolios periodically (e.g., monthly or quarterly) or based on a percentage threshold. This widely-used financial tool keeps investment strategies in line.

Ratings are processed by Upwealth, drawing from various sources, including leading rating agencies, independent analysts, and expert investors. Upwealth has developed its own model and algorithm to ensure rating integrity. We aggregate data before each release and update and display ratings for all supported coins and tokens. However, we recommend partners to conduct their own research to make informed decisions.

The ratings for each coins and tokens are expressed from A to E.

A = Excellent / Strong buy

B = Good / Buy

C = Fair / Hold or Avoid

D = Poor / Sell

E = Very Poor / Strong Sell

U = Unrated / No data

X = Failed / Scam or dead project

Upwealth's portfolio backtesting tool is employed to enhance your strategy and assess your portfolio's historical performance using past data. It aids in identifying potential trading opportunities, and a positive backtest result can boost confidence in implementing the strategy moving forward. However, it's important to use backtesting in conjunction with other tools and conduct your own research to construct a well-diversified and personalized portfolio aligned with your customers' profile.

Portfolio rebalancing is a strategy that is used to realign weightings of a portfolio of assets. It involves buying and selling assets to maintain your initial strategy, asset allocation and risk levels. This tool helps from being overly exposed to risk and can improve profitability over time. When rebalancing is applied it takes the gain from performing assets and reinvests it in assets that haven’t yet experienced such growth.

finance today with