FROM COINS TO CAPITAL

AI-Driven Digital Asset Investment and Advisory Platform for Modern Wealth Managers.

Upwealth Joins Stellar Network and DraperU's program | Sept 2024

AI-Driven Digital Asset Investment and Advisory Platform for Modern Wealth Managers.

to your Clients

Investment and Tax Advice

for Crypto Investing

Our crypto investment team conducts thorough market analysis to craft portfolios tailored to your clients' needs, risk tolerance, and financial goals. With in-depth research and strategy implementation, we take care of portfolio management, allowing you to focus on delivering personalized advice to your clients.

Let's DiscussCustomize portfolios with over 350 coins and tokens. Build and manage SMAs using our specialized tools designed for cryptocurrency investing. Tailor your crypto strategy to meet your clients' preferences.

Schedule a Demo

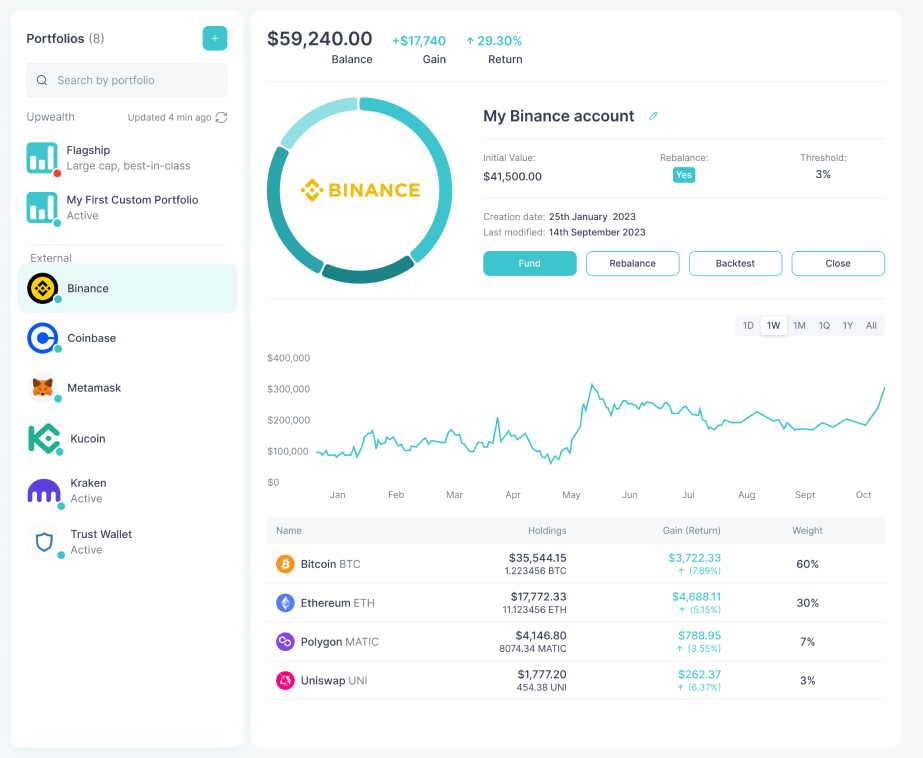

Allow clients to sync all their crypto holdings from multiple wallets and exchanges in one place. Get real-time visibility into external assets and provide personalized, AI-driven advice on their entire portfolio. Enhance your value by optimizing strategies across all client accounts, helping them reach their financial goals.

Let's DiscussOver 350+ wallets and exchanges connected by clients, managed by you and AI-powered support from Upwealth.

We provide you with powerful insights and tools, but you make the final call on what's best for your clients.

Let clients complete a brief questionnaire to create a portfolio that matches their risk profile and financial objectives.

Schedule a Demo

Disclaimer: The information provided here is for informational and educational purposes only. It is not intended as investment advice and should not be considered as such. You should conduct your own research and carefully consider your financial situation before making any investment decisions.

Registered as a DASP² with the AMF in France and updating our RIA³ registration with the SEC in the USA.

Third-party specie insurance underwritten through our qualified custodian & liquidity providers.

We uses secure gateway to institutional-grade hot and cold storage with innovative custody & liquidity solutions.